Contents:

Beta depends on a lot of factors – usually, the nature of the business, operating and financial leverages, etc. Cost Of EquityCost of equity is the percentage of returns payable by the company to its equity shareholders on their holdings. It is a parameter for the investors to decide whether an investment is rewarding or not; else, they may shift to other opportunities with higher returns. Subtract the risk-free rate from the market rate of return.

A company gave risk free return of 5%, the stock rate of return is 10% and the market rate of return is 12% now we will calculate Beta for same. First, you need to download historical stock prices and index data for the latest three or five years from a website of your choice (e.g. Yahoo! Finance, Seeking Alpha or Google Finance). You could also calculate beta simply by plotting the benchmark returns against the stock returns, and adding a linear trendline. What if there aren’t daily, weekly, or monthly changes to assess? By using only two data points , you would dramatically underestimate the true variance of those returns.

What Are Alpha and Beta in Stock Market?

This is because their market correlation was much lower, and thus the swings orchestrated through the index were not felt as acutely for those low beta stocks. Debt To Equity RatioThe debt to equity ratio is a representation of the company’s capital structure that determines the proportion of external liabilities to the shareholders’ equity. It helps the investors determine the organization’s leverage position and risk level. The Beta of the ABC stock is two, then if the stock market moves up by 1%, the stock price of ABC will move up by two percent .

- Here, we have just computed a beta value for Apple’s stock (0.77 in our example, taking daily data and an estimated period of three years, from April 9, 2012, to April 9, 2015).

- You can get a list of stocks ordered by their beta at Yahoo Finance, but we’ll now describe how you can calculate it in Excel.

- Excel is a powerful tool for calculating these parameters.

- Such risk can be mitigated or reduced by adopting diversification strategies to ensure that the returns are not affected.

- Either or both of these values may be negative, meaning that investing in the stock or the market as a whole would mean a loss during the period.

- For stocks that trade internationally, the MSCI EAFE is a suitable representative index.

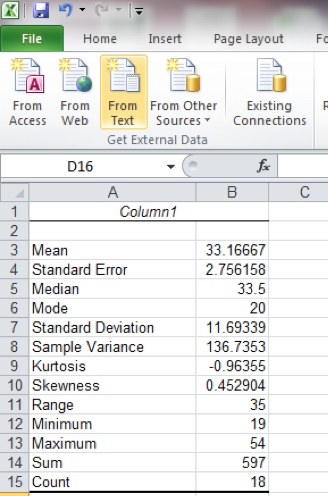

Calculate the percentage change periodically for both asset and benchmark. You can download the data from yahoo finance, as I have done below. Levered beta is the beta of a company inclusive of the effects from the capital structure. The beta that we calculated above is the Levered Beta. This Excel spreadsheet calculates the beta of a stock, a widely used risk management tool that describes the risk of a single stock with respect to the risk of the overall market.

Calculation of Beta for the stock profile

But first, you need to create a dataset where you need to insert the closing values of the stock. Here, we have taken a dataset of the “Monthly Closing of the Stock Price of ABC company”. We also take a dataset of the monthly closing of “The S&P 500” for the same year. The sensitivity and the future risk will be calculated through beta. Calculate Unlevered BetaUnlevered beta is a measure to calculate the company’s volatility without debt concerning the overall market. In simple words, it is calculating the company’s beta without considering the effect of debt.

How to Create an Amortization Schedule Using Excel Templates – How-To Geek

How to Create an Amortization Schedule Using Excel Templates.

Posted: Tue, 09 Aug 2022 07:00:00 GMT [source]

Excel SLOPE FunctionThe Slope function returns the slope of a regression line based on the data points recognized by known _y values and known _x values. 0A beta value between 0 and 1 denotes that an asset’s returns are less volatile than those of the market. In other words, the asset may offer a more steady return since it is less susceptible to market fluctuations. The required rate of return is the minimum return an investor will accept for an investment as compensation for a given level of risk. It is important to follow strict trading strategies and rules and apply a long-term money management discipline in all beta cases.

You can add the Data Analysis by following the below process. Press ENTER, and you will get the beta of your stock. Regression is a statistical measurement that attempts to determine the strength of the relationship between one dependent variable and a series of other variables. Incidentally, it is important to differentiate the reasons why the beta value that is provided on Google Finance may be different from the beta on Yahoo Finance or Reuters. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

Using Excel Graphs to Determine Beta

Analysis ToolPakExcel’s data analysis toolpak can be used by users to perform data analysis and other important calculations. It can be manually enabled from the addins section of the files tab by clicking on manage addins, and then checking analysis toolpak. Financial StatementsFinancial statements are written reports prepared by a company’s management to present the company’s financial affairs over a given period . Basic Definition of Beta –Beta measures the stock risks in relation to the overall market. Note that classical covariance theory may not apply, because financial time series are “tail heavy.” In fact, the standard deviation and mean for the underlying distribution may not exist! So perhaps a modification using quartile spread and median instead of mean and standard deviation could work.

- Multiply the beta value by the difference between the market rate of return and the risk-free rate.

- The result is then multiplied by the correlation of the security’s return and the market’s return.

- Calculate the slope of the linear regression line through data points for the stock and the benchmark index.

Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. Andrew has a Bachelor of Business Administration Degree , Accounting and Finance from Pace University. When it comes to analyzing investments, the concepts of alpha and beta are essential to understand.

Risk-return tradeoff is a fundamental trading principle describing the inverse relationship between investment risk and investment return. Firstly, we have to create a dataset that must contain a set of Portfolio Returns and Market Returns. Beta provides a real picture of the investment portfolio. It also helps in the evaluation of discounted cash flow. FREE EXCEL RESOURCESLearn MS Excel right from scratch. Master excel formulas, graphs, shortcuts with 3+hrs of Video.

A negative covariance means the stocks move opposite of each other. Without any further delay, we will jump into the stepwise procedure to calculate the alpha and beta in Excel. We will use some built-in functions of Excel to determine the alpha and beta values. Beta measures how much an investment’s returns move in response to changes in the standard returns.

The market goes up 2%, your stock goes up 2%; the market goes down 8%, your stock goes down 8%. In the second column, put down index prices; this is the “overall market” you’ll be comparing your beta against. In the third column, put down the prices of the stock for which you are trying to calculate beta. This produces a sum of 11 percent, which is the stock’s expected rate of return.The higher the beta value for a stock, the higher its expected rate of return will be. Many utility stocks, for example, have a beta of less than 1. Conversely, many high-tech stocks on the Nasdaq have a beta greater than 1, offering the possibility of a higher rate of return, but also posing more risk.

how to calculate beta in excel is also known as asset beta because the firm’s risk without debt is calculated just based on its asset. Technically speaking, Beta is a measure of stock price variability in relation to the overall stock market (NYSE, NASDAQ, etc.). Beta is calculated by regressing the percentage change in stock prices versus the percentage change in the overall stock market. CAPM Beta calculation can be done very easily on excel. Investors looking for low-risk investments might gravitate to low beta stocks, meaning their prices won’t fall as much as the overall market during downturns. However, those same stocks won’t rise as much as the overall market during upswings.

Then we simply calculate the fractional daily returns, as described in the picture below. Where rs is the return on the stock and rb is the return on a benchmark index. Now that we have the results of our regression, the coefficient of the explanatory variable is our beta . I am looking forward to an article on Forex in the near future. Thank you so much for the article and the worksheet. Please note that for each of the competitors, you will have to find additional information like Debt to Equity and Tax Rates.

That’s why it’s not a terribly reliable predictive tool. Create two return columns to the right of your price columns. One column will be for the returns of the index; the second column will be the returns of the stock. You’ll be using an Excel formula to determine the returns, which you’ll learn in the following step. As a result, beta is often used as a risk-reward measure, meaning it helps investors determine how much risk they are willing to take to achieve the return for taking on that risk. A stock’s price variability is important to consider when assessing risk.

Using Beta to Understand a Stock’s Risk – Investopedia

Using Beta to Understand a Stock’s Risk.

Posted: Wed, 29 Aug 2018 15:07:52 GMT [source]

We hope that you have learned well about Beta Value, what it is, and how to calculate Beta in Excel. And you are ready to implement it yourself and estimate the performance of your desired stock, mutual fund, or portfolio. As a next step, we insert values into our formula, which is range of all values of the index/benchmark we’ll be using to compare. Now, go to Historical Data, select the time period for which you need to analyze and then confirm it by clicking Apply.

As another example, imagine that Frank’s Funeral Service has a beta of 1.5 when compared to the S&P. If the S&P falls 10%, expect Frank’s stock price to fall more than the S&P, or about 15%. Determine the rate of return for the market or its representative index. In this example, we’ll use the same 8 percent figure, as used above. A company has below asset and benchmark price from Jan-2018 to Dec-2018. Get past security price for an asset of the company.

12 Default Microsoft Excel Settings You Should Change – How-To Geek

12 Default Microsoft Excel Settings You Should Change.

Posted: Wed, 28 Sep 2022 07:00:00 GMT [source]

You can use the regression between the two sets of data to calculate the beta. This article focuses on four effective and quick ways how to calculate beta in Excel. Unlevered beta, on the other hand, removes the effects from financial leverage to isolate the risk related to a company’s assets (i.e. pure business risk without any financial risk). For that reason, unlevered beta is often called “asset beta” because it measures the expected volatility of the underlying asset as if the company is completely financed by equity.

If the market or index rate of return is 8% and the risk-free rate is again 2%, the difference would be 6%. Subtract the risk-free rate from the stock’s rate of return. If the stock’s rate of return is 7% and the risk-free rate is 2%, the difference would be 5%. This is the rate of return an investor could expect on an investment in which his or her money is not at risk, such as U.S.

We have tried to insert VBA code to create a VBA user-defined function in our dataset. The code will create a function named Beta from which we can calculate the beta in our dataset. After calculating the returns, you can calculate beta through various methods that we have stated below. Beta is essentially the regression coefficient of a stock’s historical returns compared to those of the S&P 500 index. This coefficient represents the slope of a line of best fit correlating the stock’s returns against the index’s.