Content

A third option is to engage in just-in-time inventory purchases to reduce the inventory investment, though this can increase delivery costs. You might also consider returning unused inventory to suppliers in exchange for a restocking fee. Or, consider extending the number of days before accounts payable are paid, though this will likely annoy suppliers.

- Some businesses—often large ones with separate finance departments—choose to calculate net working capital differently by excluding cash or certain short-term liabilities.

- The majority will accept the new, extended payment terms, freeing up working capital that you can use for your business.

- Net working capital is a more useful measure of a company’s ability to pay off its debts, as it considers the amount of money tied up in inventory and accounts receivable.

- After understanding the definition and the formula to derive your company’s net working capital, how about we give you an example for better understanding?

- In short, net working capital management is critical for a company’s positive relationships with lenders, suppliers, employees and customers.

A cash flow forecast can help SMEs anticipate their cash inflows and outflows and identify potential cash shortfalls. It allows SMEs to plan for future working capital needs and take appropriate action to improve their cash position. Accounts Receivable and Accounts Payable are essential components of Net Working Capital , and they can significantly impact a company’s liquidity position. Is not authorised by the Dutch Central Bank to process payments or issue e-money. An application under Electronic Money regulations 2011 has been submitted and is in process. Conversely, retailers often delay payments to suppliers until the products they offer are sold.

Advantages of Custom ERP Solutions for your Business

The main difference between gross and net working capital is that gross working capital does not consider the company’s short-term liabilities, while net working capital does. Net working capital is a more useful measure of a company’s ability to pay off its debts, as it considers the amount of money tied up in inventory and accounts receivable. The simple and most common way to calculate working capital, also known as net working capital, is to divide current assets by current liabilities. The result is the current ratio, which is a formula often used to gauge the health of a business. The average collection period measures how efficiently a company manages accounts receivable, which directly affects its working capital. The ratio represents the average number of days it takes to receive payment after a sale on credit.

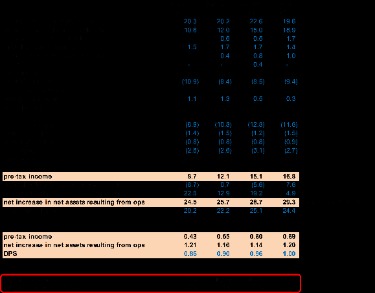

If the following will be valuable, create another line to calculate the increase or decrease of net working capital in the current period from the previous period. Yes, it is bad if a company’s current liabilities balance exceeds its current asset balance. This means the company does not have enough resources in the short-term to pay off its debts, and it must get creative on finding a way to make sure it can pay its short-term bills on time. For example, say a company has $100,000 of current assets and $30,000 of current liabilities.

Resources for Your Growing Business

We strive to provide you with information about products and services you might find interesting and useful. Relationship-based ads and online behavioral advertising help us do that. And affiliated banks, Members FDIC and wholly owned subsidiaries of Bank of America Corporation. Working capital can also be used to pay temporary employees or to cover other project-related expenses. To make sure your working capital works for you, you’ll need to calculate your current levels, project your future needs and consider ways to make sure you always have enough cash. You can also use another formula to calculate your company’s net working capital.

A favorable net working capital ratio is 1.5 to 2.0, depending on the industry the business is in. Therefore, to adequately interpret a financial ratio, a company should have comparative data from previous periods of operation or its industry. But if there is an increase in Net Working Capital Definition the NWC, it isn’t considered positive; rather, it’s called negative cash flow. And obviously, this increased working capital is not available for equity. Current LiabilitiesCurrent Liabilities are the payables which are likely to settled within twelve months of reporting.

Net Working Capital: Definition, Formula and Calculation

Most companies need working capital well above zero because accounts receivable and inventory take time to convert to cash and sometimes prove uncollectable or unsellable. Retailers, restaurants, and other companies that quickly generate cash from accounts receivable and inventory often require less net working capital. Net working capital shows how well a business can pay its bills in the immediate future. It can also reveal whether a company uses its short-term assets effectively. Business owners only need a balance sheet to calculate this important metric.

It depicts the balanced manner in which a business manages its debts, while also putting enough cash into long-term investments for the scaling of the business. An extremely https://kelleysbookkeeping.com/ high working capital only shows that a business is not using its profits well. The excess cash can be used for investing in inventory, expansion, or even human capital.

Net working capital formula

Cash flow refers to the movement of cash in and out of a company over time. It includes both operating cash flow (cash generated or used in the company’s day-to-day operations), investing cash flow , and financing cash flow . It’s important to note that having negative net working capital does not necessarily mean that a company is in financial trouble. Companies with negative net working capital may need to improve their working capital management, such as enhancing their collections processes or negotiating better payment terms with suppliers. Negative net working capital can cause concern as it suggests that a company may struggle to meet its short-term obligations.

What is a good net working capital ratio?

An optimal net working capital ratio is 1.5 to 2.0, but that can depend on the business's industry. To adequately interpret a financial ratio, a business should have comparative data from previous time periods of operation or from its industry.

The quick ratio is a calculation that measures a company’s ability to meet its short-term obligations with its most liquid assets. Working capital is important because it is necessary for businesses to remain solvent. After all, a business cannot rely on paper profits to pay its bills—those bills need to be paid in cash readily in hand. Say a company has accumulated $1 million in cash due to its previous years’ retained earnings. If the company were to invest all $1 million at once, it could find itself with insufficient current assets to pay for its current liabilities.